Find out what CEOs and Conservative MPPs have in common

Workers got an average 6.6% wage increase, ODSP recipients got a 6.5% increase and 80,000 Ontarians are unhoused. So, why do we put up with CEOs and Conservative MPPs padding their incomes?

Ratio of CEO pay to average worker pay Credit: The Canadian Centre for Policy Alternatives (CCPA) report, Company Men: CEO Pay in Canada in 202

It’s that time again when media reports abound about the growing pay gap desparity in Canada. A credible source for that information is the Canadian Centre for Policy Alternatives (CCPA) report, Company Men: CEO Pay in Canada in 2023, which revealed the top 100 CEOs earned an average 210 times more than the average worker.

The highest-paid CEOs – three women and 97 men – took home, on average, $13.2 million. This is the third best showing with CEOs taking home an average above $14 million in 2021 and 2022.

That means that by 10:54 am on the first working day of the year, these 100 CEOs had made an average of $62,661. That is the equivalent of the average Canadian worker’s annual income.

The CEO-to-worker pay ratio dropped slightly from all-time highs set in 2021 and 2022 when corporations increased prices and raked in record profits. In both 2021 and 2022, the average worker saw their wages increase by only 3.1 per cent. At the same time, prices increased by 4.8 per cent (2021) and 6.3 per cent (2022).

CCPA makes some interesting observations about the top 100 CEOs. Most are men, indicating the glass ceiling is still firmly in place. Most, 76 per cent, were not hired from outside, but are company men promoted from within.

That busts the myth that CEOs are gods who must be wooed and overly compensated in order to attract them. Reality is their value lies in knowing the company, its various businesses and that industry inside out and that comes from spending an average 21 years with that one company.

The exponential growth in pay is not credited to salary, pensions or benefits, but rather oversized bonuses with each CEO receiving an average $10.7 million.

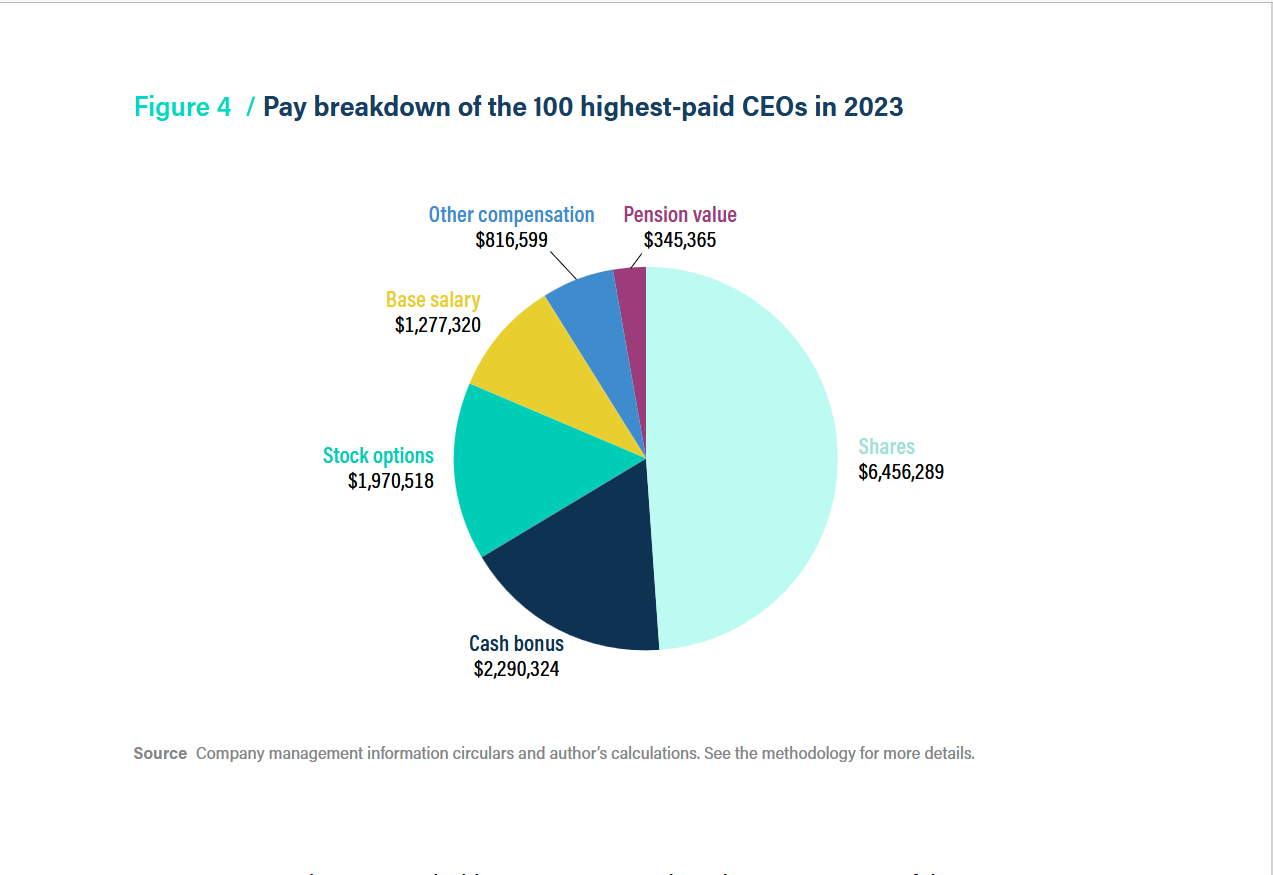

Pay breakdown of the 100 highest-paid CEO’s in 2023 Credit: The Canadian Centre for Policy Alternatives (CCPA) report, Company Men: CEO Pay in Canada in 2023

The average salary of the top 100 CEOs is $1.3 million. That salary has remained constant over time even after adjusting for inflation. Salaries and pensions together make up a mere 12 per cent of the average CEOs pay package.

Four-fifths of the CEOs pay comes from bonuses also known as “performance-based compensation” or “variable compensation.”

The thinking behind bonuses is that executives will receive compensation that aligns with the shareholder experience. That should mean when the company does well, executives get a big pay out, but when the company performs badly, executive bonuses evaporate. That’s another myth because CEO bonuses keep rising regardless of performance. That’s because when company profits drop, as in the case of pandemic-related economic shut downs, the goal posts shift to ensure bonuses get paid.

According to the CCPA report, in 2020, half of the 100 highest-paid CEOs either received government support and/or saw their bonus formulas changed after the fact to ensuring bonuses despite plummeting profits.

That begs the question, why are companies not penalized for redirecting government money intended to help those companies pay employees, cover personal protective equipment and stay in business, to cover incredibly large CEO bonuses? This is exactly what the CCPA report means when it states that bonuses are only capped on the downside while essentially being unlimited on the upside.

In 2023, workers saw their average weekly wage – including overtime – rise by 6.6 per cent. The CCPA maintains that this reflects a positive trend of workers making real wage gains and is a testament to the value of Canadian labour market institutions.

However, those gains were not distributed equally across all sectors. Transportation, warehousing, education and public administration received lower increases.

So, I thought it would be interesting to have a look at what’s been happening to the incomes of Ontario Members of the Provincial Parliament (MPP) since Doug Ford became Premier.

Since 2008, MPPs have been paid $116,550 annually. And, while Mike Harris put an end to pensions for the 124 members of Ontario’s legislature in 1996, MPPs serving six years are entitled to retirement allowances that are capped at 75 per cent of their salary.

Premiers often find creative ways to get around the wage freeze including appointing their members to serve as cabinet ministers, parliamentary assistants, committee chairs and co-chairs. Ford has taken this practice to daring new heights.

While MPPs make $116,550 annually, cabinet ministers receive a salary of $165,851 per year. Ford’s 30 ministers cost taxpayers an additional $1.5 million thanks to the $49,851 bump in pay each Conservative cabinet minister receives.

The 43 Conservative MPPs appointed to serve as parliamentary assistants saw their pay bumped to $140,000. That $23,500 increase per MPP costs tax payers $1,010,500 a year. Both Health Minister Sylvia Jones and Citizenship and Multiculturalism Minster Michael Ford are among the cabinet ministers assigned two legislative assistants – yes, some ministers have more than one.

Conservative MPPs chair six of eight committees earning an additional $16,000 annually each costing tax payers $96,000. Conservative MPPs co-chair the remaining two committees.

These salaries do not include the benefits that each MPP is entitled to.

Let’s see how that plays out in real income and why not start with Premier Doug Ford who became Premier June 29, 1018. His base salary was $112,770 with an additional $188,000 in benefits for a grand total of $300,770 prorated to reflect the six months Ford was Premier in 2018.

Year Salary Benefits Raise Total Income

2019 $208,974 $321,000 85.3 per cent $529,974 *This reflects Ford’s income for his first full year as Premier.

2020 $208,974 $316,000 0 $524,974

2021 $208,974 $304,000 0 $512,974

2022 $208,974 $291,000 0 $499,974

2023 $208,974 $291,000 0 $499,974

Minister of Municipal Affairs and former Minister of Long-term care, Paul Calandra

2019 $136,247 $223,000 0 $359,247

2020 $138,928 $223,000 2 per cent $361,928

2021 $144,356 $218,000 3.9 per cent $362,356

2022 $165,851 $234,000 14.9 per cent $399,851

2023 $165,851 $234,000 0 $399,851

Minister of Energy and Electrification and former Minister of Education, Stephen Lecce

2019 $150,531 $242,000 0 $392,531

2020 $165,851 $259,000 10.2 per cent $424,851

2021 $165,851 $247,000 0 $412,851

2022 $165,851 $234,000 0 $408,851

2023 $165,851 $234,000 0 $408,851

Minister of Health and former solicitor General, Sylvia Jones’ history as an MPP began in 2008 and it’s important to note that in 2018 her salary and benefits increased 21.4 per cent to $391,474.

2019 $165,851 $263,000 17.2 per cent $428,851

2020 $165,851 $259,000 0 $424,851

2021 $165,851 $247,000 0 $412,851

2022 $165,851 $234,000 0 $399,851

2023 $165,851 $243,000 0 $408,851

Minister, Seniors and Accessibility, Raymond Cho

In 2018, Cho received a 21.4 per cent increase when he became Minister, Seniors and Accessibility.

2019 $182,436 $263,000 17.2 per cent $445,436

2020 $182,436 $259,000 0 $441,436

2021 $182,436 $247,000 0 $429,436

2022 $182,436 $234,000 0 $416,436

2023 $182,436 $234,000 0 $416,436

*Income information from ontariosunshinelist.com. The Ontario Sunshine List is a yearly list of public sector employees in Ontario who earn more than $100,000.

Parliamentary calendar for 2024 Credit: Legislative Assembly of Ontario website

It’s important to keep in mind that the Conservatives sat at Queen’s Park a total of 19 weeks in 2024.

While Conservative MPPs are having their incomes padded, the average worker in Ontario earns $54,834 annually. Folks on Ontario Works (OW) and Ontario Disability Support Program (ODSP) receive $733 and up to $1,368 per month respectively.

How can Ford justify these extravagant Conservative MPP incomes particularly after the Association of Municipalities of Ontario reported more than 80,000 people in Ontario were unhoused in 2024? These folks found themselves unhoused due to multiple intersecting crises — many put in place by the Ford government like Bill 124 — that were exacerbated by the Ford government removing rent controls.

Ontario has an unhoused crisis on its hands due to the commodification of a human right — housing — working in conjunction with the Ford government removing rent controls.

Some unhoused folks have jobs and families, some of these folks are on ODSP/OW, while others have no income and are in need of an address so they can apply for social assistance. Wait lists for affordable housing have over 286,000 households waiting an average of five years for units. All of these folks deserve affordable homes, not criminalization that Ford’s proposed encampment legislation will impose.

Ford is in charge of a majority government that was mandated to deal with trade tariffs as well as to robustly fund public education at all levels, universal healthcare, childcare, public transit, stimulate the economy and protect the public commons.

Instead, Ford gave himself a mandate to privatize, commodify and destroy Ontario — something he failed to share during his campaigns.

Ontario Health Coalition sign Credit: Doreen Nicoll

If Ford were truly creating and protecting Ontario jobs, then why did he award a $100-million contract to Elon Musk’s company, Starlink, to connect 15,000 homes and businesses in underserved communities to high-speed internet? Yes, only 15,000 homes! That works out to $6,666.67 per installation. Is Ford really claiming there’s not a single company in Ontario or even Canada that was up to this task?

Truth is, Doug Ford is really expensive and Ontarians can’t afford another Conservative government!

Thankfully, the CCPA has had some wins reigning in CEO pay. The registered charity and non-profit, has been pushing for fairer taxes as one means of reducing the extreme pay gap between CEOs and the average worker.

On July 1, 2021, the federal government capped the stock option deduction at $200,000 a year. Previously, when CEOs were paid in stock options, they were taxed as if this was a profit on a long-held stock and not working income, which it clearly is. Since the federal government capped this tax loophole in 2021, the proportion that CEOs make from stock options compared to their overall pay has been cut in half.

The 2024 federal budget increased the inclusion of capital gains to 66 per cent. For comparison, the inclusion rate on salaries and wages is 100 per cent. Of particular importance for CEOs is that this applies to profits made in a single year that are more than $250,000.

Since most Canadians are never going to have stock profits of a quarter of a million dollars in a single year, this change will affect the very few Canadians but will affect the highest-paid 100 CEOs, who hold an astounding $45.2 billion in shares in their own companies. The 2024 federal budget change could raise $955 million in tax from just 100 CEOs.

The CCPS knows more can be done including a wealth tax on those worth more than $10 million. That alone could raise $32 billion a year to help address affordability for food and housing as well as the laundry list of provincial and federal services that need robust, stable, ongoing funding.

Canada’s marginal tax rate for the richest Canadians is low. The combined federal and provincial taxes for the top income levels amounts to about 50 per cent, with some variation by province. The CCPS points out that during the post-war years, top marginal income tax brackets were in the 70 per cent range, and since the trickle-down theory of Thatcher, Reagan and Mulroney has been soundly debunked, it’s time to ensure the wealthiest Canadians pay their fair share of taxes to support the public commons and public goods.

*The Leadnow community has launched several local campaigns calling on mayors and city councils to come out against Ford's draconian legislation aimed at criminalizing homelessness, with plans to bypass the courts to enforce it.

Leadnow supporters have started petitions in 13 cities and towns across the province. Sign an existing petition or start one in your community here.

Thanks to everyone who read today’s article. With your continued support, a little Nicoll can make a lot of change.

This is unfair and calling an election at this time is another unnecessary expenditure.

The average worker cannot afford a house at the present prices. I support the voice of Lead Now.